Term Deposits

Term deposits in Kenya are fixed-term savings accounts offered by banks. Customers deposit a sum for a set period at an agreed-upon interest rate. Features include fixed maturity dates, higher interest rates than regular savings accounts, and safety through deposit insurance schemes. There are usually minimum deposit requirements, and interest can be paid out periodically or at maturity. Customers often have renewal options. Term deposits are popular for predictable returns and capital preservation.

The Board of Trustees reassures you the financial market’s volatility are cyclical and that both Scheme’s strategies have modelled a long-term investment approach that accounts for short-term effects on the investment fund. We hold the belief to ensure a sustainable kitty to all Scheme Members.

The following charts provide the distribution of the investments based on portfolio allocation and market value of investments.

5-Year Trend on Assets Under Management

The Scheme’s Investment Portfolio recorded a 21.29% growth over 5 years to close at Ksh.9.893 billion as of 30th June 2025.

Asset Allocation

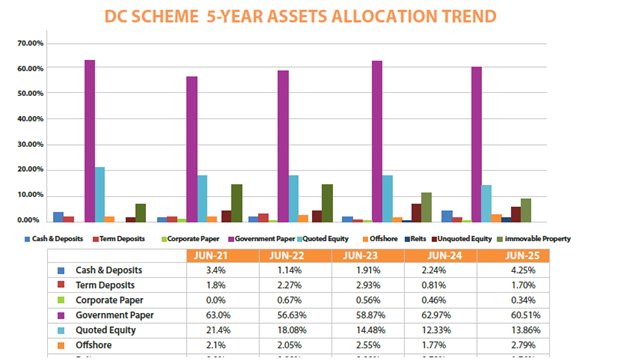

The charts below provide the allocation to different asset classes based on market value of investments.

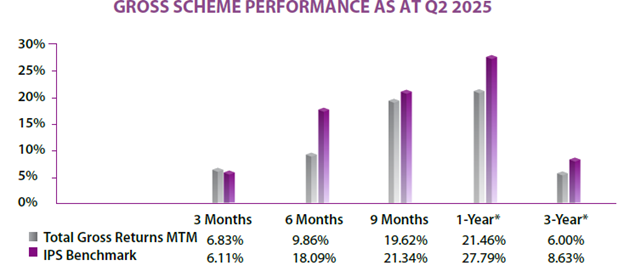

5-year Overall Scheme Performance

The Chart below provides the Scheme’s 12 months return for the period ending 30th June 2025 over the past 5 years. The Scheme’s return for the period 31st March 2025 to 30th June 2025 is 6.83% (MTM), 3.73% (HTM) against the IPS benchmark of 6.11%. The positive performance during the quarter was mainly attributed to revaluation gains in bonds markets and a rally in stock prices especially the banking stocks and other large capitalization stocks.

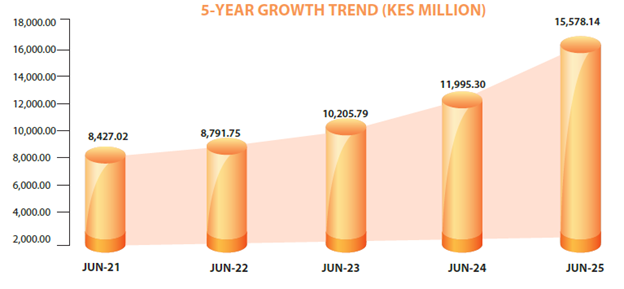

5-Year Trend on Assets Under Management

The Investment Portfolio recorded a 84.86% growth over 5 years to close at Ksh.15.578 billion as of 30th June 2025.

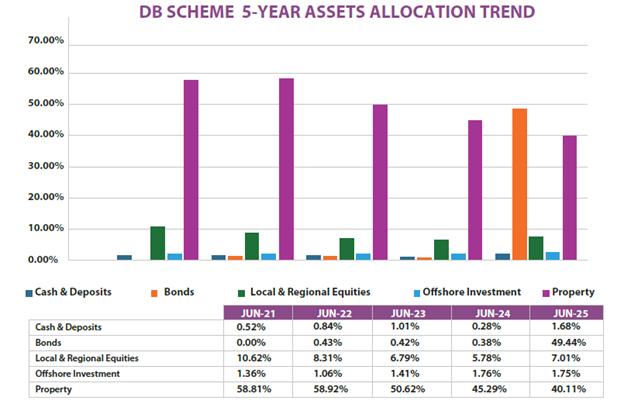

Asset Allocation

The charts below provide the allocation to different asset classes based on market value of investments. All Scheme assets are compliant with the IPS limit. We continuously restructure the portfolio and aim to diversify to investments with high returns that’s within the permissible

risks as per the 10-year strategy.

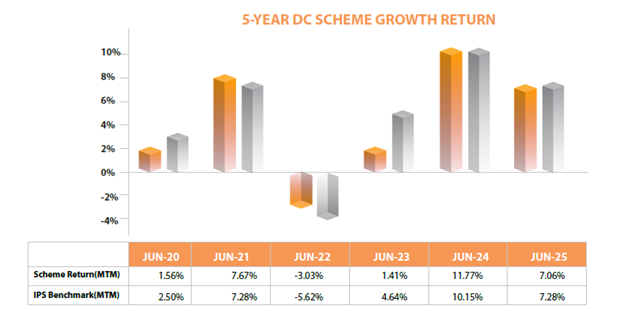

5-year Overall Scheme Performance

The Chart below provides the Scheme’s 3-months return for the period ending 30th June 2025 over the past 5 years. The Scheme’s return for the period 31st March 2025 to 30th June 2025 is 7.06% (MTM), 7.55% (HTM) against the IPS benchmark of 7.28%. The positive performance was attributed to positive bond revaluation, and rally in prices of large capitalization stocks in the local equities market.